Healthcare can be expensive. Luckily, if you have Medicare, there are several ways to reduce your costs.

Stay Up to Date on Medicare!

Join the Fair Square Medicare Newsletter to stay informed on cost savings, changes to Medicare, and other valuable healthcare information.

Certain Medicare costs qualify as tax deductions. Claiming these medical expenses on your tax return can lower your taxable income (i.e., reduce your taxes).

Let's dive deeper into the types of Medicare expenses that qualify for tax deductions and discuss how to claim them on your tax return.

Yes. You can deduct your

Medicare

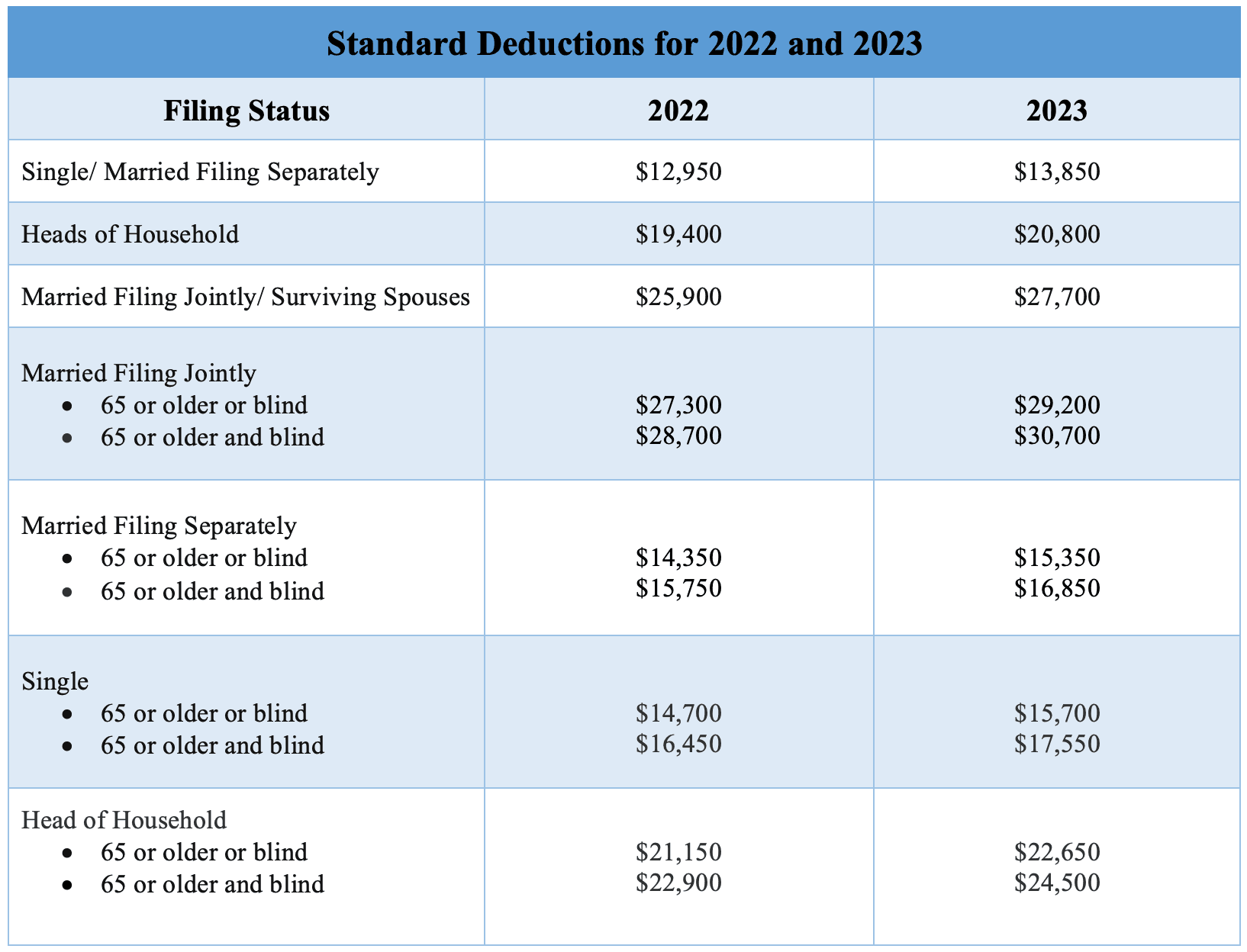

expenses from your tax returns if you meet the eligibility requirements.If you claim the standard deduction, check the current amount before filing your tax return. (Standard deductions change periodically).

Here's a list of standard deductions for 2022 and 2023:

Standard Deductions for 2022 & 2023

Note: To maximize your tax benefits, you might want to itemize your deductions rather than claim the standard deduction. However, this is possible only when the total of your itemized deductions, including charitable donations, medical expenses, and state and local taxes, is higher than your standard deduction.

The amount of tax-deductible Medicare expenses depends on your:

In order to qualify for a tax deduction, your Medicare expenses must exceed 7.5% of your AGI (adjusted gross income). You can only claim a deduction for costs above this threshold.

You can claim a tax deduction for medical expenses you paid for yourself, your spouse, or a qualifying dependent.

Here are some examples of tax-deductible Medicare expenses:

In addition, you can also deduct taxes for the following medical expenses:

Some medical costs don't qualify for tax deductions. Examples of non-tax-deductible expenses include the following.

Keep track of all your out-of-pocket costs, including receipts, bills, and statements from your healthcare provider. You will need to provide this documentation if you are audited by the Internal Revenue Service (IRS).

Calculate your total out-of-pocket costs. Then, compare them to the applicable threshold (7.5% of your AGI).

Itemize your deductions on your tax return using

Form 1040

, Schedule A.Complete the appropriate tax form and enter the total amount of your deduction. Attach any supporting documentation to your tax return. File your tax return by the deadline.

Tax deductions can help offset Medicare expenses, lower your taxable income, and potentially increase your tax refunds. Some qualifying Medicare expenses include premiums, out-of-pocket costs, and more.

To claim your tax deductions, follow these steps:

If you're not sure about your deduction eligiblity or have questions about the process, give us a call at 1-888-376-2028. At

Fair Square Medicare

, we'll help you identify tax-deductible expenses that will bring you financial relief.Stay Up to Date on Medicare!

Join the Fair Square Medicare Newsletter to stay informed on cost savings, changes to Medicare, and other valuable healthcare information.