Loading...

Some of you know that, besides humans at my house, I’ve got dogs, chickens, fish, and honeybees (you can even see my live BeeCam here). Only about ten days ago, I added another hive to my backyard. The inside of a hive (one that humans manage, anyway) is a neat, tidy affair, made up of tightly-packed frames that are spaced apart by identical, precise amounts.

I had a few extra wooden frames, but I didn’t have the sheet that fits within it, which is where the bees build out their honeycomb. I thought to myself, “well, bees have built combs without frames for millions of years, so maybe I should just leave the space and let them create one.”

Well, yes, I could do that, but after reading up on the subject, I learned it wasn’t a great idea. If you leave the open space, the bees will certain construct their own “wild” comb, but the tidy order of the hive will get disrupted, and they’ll basically built a honeycomb in the big empty space, filling up the entire area. It would be OK, but it just isn’t kosher (according to my research). So I went ahead and just ordered some of the extra “sheets” that fit within the frame. They would take about a week to arrive.

I figured in a week’s time, the bees would occupy themselves with the 7 other frames in the hive, and the empty space would just remain a big empty space. Once the sheet arrived, I’d assemble it inside the frame, remove the roof of the hive, brush the bees away, and gently insert the new frame. Easy. No problem.

So, today, the sheets arrived, and I dutifully took one of them and carefully assembled the new frame. I donned my always-sexy beekeeper’s jacket, hood, and gloves, and I went out to the new hive, reviewing in my mind how I would gently put the new frame in, disturbing the bees as little as I could. I set the new frame down, opened the roof, and……..

Holy Lord! Within that empty space was, from the top to the bottom, a completely-constructed (and absolutely geometrically perfect) honeycomb, and it was already about 10% full of honey! Good GOD these creatures work fast! I seriously could hardly believe my eyes, not only because they had worked with such speed (remember, this was in just a week’s time) but that the thing they made was so absolutely and naturally beautiful. It was a true work of art.

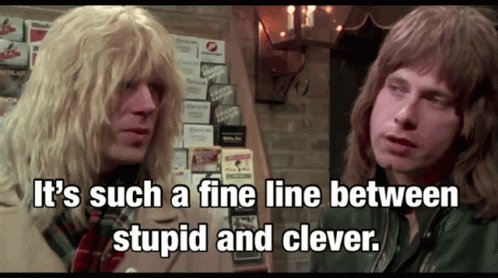

I feel pretty damned guilty, I’ve got to tell you, pull this thing out. The bees, it probably need not be said, were pissed beyond belief at this giant alien that was yanking all their hard work out. The honeycomb looked kind of like the picture below, except without the ape-man biting into it:

Once I got inside, I felt like a thief. So I broke off the portion of the comb that had honey, and I put it into a bowl, walked back outside, and made an offering to the bees (“Yeah, thanks, Tim, for wrecking a week’s worth of effort. You’re a pal.“) I’m hoping that, at a minimum, they can take the nectar and honey back inside, saving them the trouble of foraging for it again. I’m not sure if they’ll do anything with the wax, but I doubt it. (It looks small, because about 90% of the honeycomb was just empty wax; I only brought back the portion with honey).

As for the big empty wax comb that I had left over, I was struck by how lightweight it was – – it felt like something NASA would have had created. But I decided to melt it in a pot, and, hey, why not, make a couple of cute honey bears out of it! Here they are (the darkness at the top of the right one is from impurities in the wax):

So – – nothing to do with trading. Nothing to do with business. Nothing to do with Silicon Valley. Just me and some bees on a lazy weekend afternoon. Bees are truly a miracle. The more I learn about them, the more I am in awe.

Life was no accident.

Perhaps you’ve heard that crypto is (once again) crashing:

So now that Tesla has proudly boasted that they would accept Bitcoin for their cars (who CARES??) and someone bought one a few days ago, I guess Tesla gets $10,000 less on the vehicle sale. So is that a benefit?

Let’s just pretend for a moment that we’ve reached the absolute top (just as a thought experiment); what would some of the tell-tale signs be?

- Dogecoin (created in three hours as a JOKE) reaching $52 billion in value;

- Coinbase (symbol COIN) going public within hours of the lifetime high of BTC;

- Me actually offering up some enthusiasm for a few alt-coins

This isn’t the first time crypto has had a tumble. Hell, it lost virtually all its value in the year 2018, only to go up almost TWENTY-FOLD afterward. So there’s no point in saying this is The End.

I will note however, things aren’t looking so great. Bitcoin has clearly lost its momentum, and we’ve got a very clear pattern failure:

As for the crypto crowd, honestly, there’s no group more sensitive, so I truly refrain from saying anything, since they are even loopier than Precious Metals Kooks. I mean, just as a purely hypothetical, if I tweeted out “It’s weird that MTG is so against trannies, since she looks like one” (again, strictly hypothetically) or, instead, “Cryptos Suck“, I guarantee I’d get far worse blowback from the latter. Promise.

Contributed by Sloper Eldar Bob: This soft stop method is probably not great for an account that is subject to the Wash Sale Rule.

Stops have frustrated me time and again.

Each morning, I start off with a list of positions and their dollar value. There is a list of short term long positions. Among those positions, I have used a different colored pen and put a box around those symbols which might turn against me. Likewise, I have put a box around the dollar size of the holdings which have a nominal value which is greater than my ideal position limit. I have also put a box around the nominal values of names to which I might want to add.

The second column is for short positions or short ETFs.

Then there is a third column of names worth considering for long term holds. It is usually a partial list of 10 to 15 holdings ranked from the largest positions down.

At the top of the college ruled notepad, there is a blank space. In the top left corner, I place the account’s net asset value which I update through the session. Updating provides a clear objective measure of success or failure.

It is not realistic to expect that the net asset value will increase each day. If the net asset value declines in a way that is alarming it is a call to decrease exposure.

The net asset value (NAV) must always be protected. One can come back from a 10% loss fairly easily, unless they have hit a dry run and keep throwing money at their ill timed purchases. A 20 percent loss becomes a bit of a bitch to recover from. And several times a year, I will close all of my short term positions, raise cash and step back.

Sometimes that may not be enough. At that point, I cull parts of my long term positions that are listed in the far third column on the right.

Managing the NAV is the most critical action of the day. A side benefit to this outlook is that one does not get caught up in their predictions for individual names. Individual names are part of a diversified whole. If I am over-weighted in a name for which I have great expectations, those expectations are secondary. And, in this no commission world, there is little slippage in buying back the shares. The big draw downs have to be avoided, if one wants to play.

With the NAV under control, one can gauge what is happening in individual securities. For example there are certain down bars that I will not hold unless they recover dramatically by a point near the close. You just want to avoid getting caught in that Slope of Hope. If it does recover, then your stop is the prior day’s low. A broader question to ask is: Is price under control? We all use measures for this from an analysis of trendlines, horizontal areas of accumulation and distribution Bollinger bands, average true range etc.

That is a second psychological advantage to one’s focus being on the NAV. Once the NAV is protected, one can look at a day’s price movement with greater objectivity. After all, you worked hard to get an entry price with an edge. If your judgment was correct, the position should be acting within the risk reward parameters.

And, that’s the framework of my soft stops.