Introduction

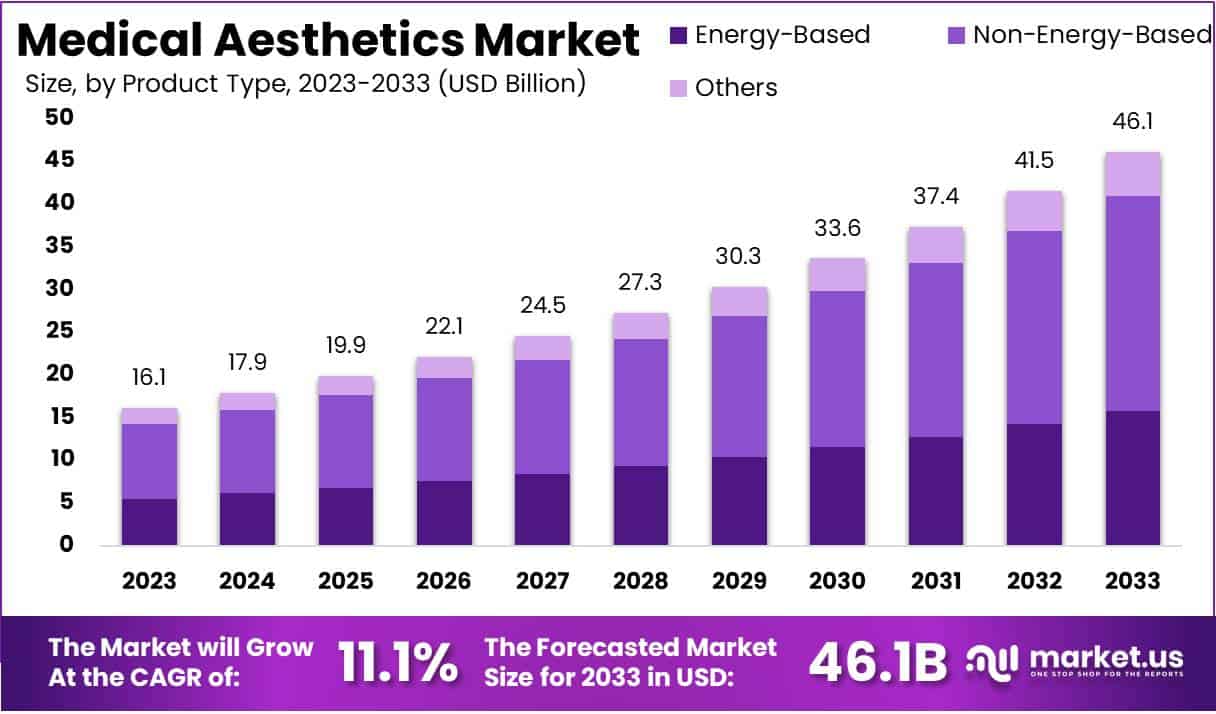

The Global Medical Aesthetics Market is poised for substantial growth, expected to expand from USD 15.3 billion in 2022 to USD 51.7 billion by 2032, marking a robust compound annual growth rate (CAGR) of 14.7% over the forecast period. This growth can be attributed to several factors including technological advances in non-invasive procedures such as laser and ultrasound treatments, which have enhanced consumer outcomes and broadened the appeal of aesthetic treatments.

Challenges within the market include the high costs associated with medical aesthetic procedures, which may limit market accessibility primarily in developing regions. Furthermore, the lack of comprehensive insurance coverage for these treatments compounds affordability issues, deterring wider adoption.

Recent developments have significantly shaped the landscape of the medical aesthetics industry. For instance, in June 2023, FDA approvals for new laser treatments targeting pediatric skin conditions highlight the ongoing innovation and regulatory advancements in the sector. Moreover, companies like Allergan Aesthetics are leading initiatives to promote racial and ethnic diversity in the field, reflecting a broader commitment to inclusivity within the industry.

Overall, while economic uncertainties pose a threat to the discretionary nature of aesthetic treatments, the medical aesthetics market is supported by strong fundamentals including rising consumer demand, ongoing product innovation, and significant investment from both private and corporate investors. This positions the market for continued growth, driven by both technological advancements and evolving consumer trends.

Key Takeaways

- Market Growth Projection: The global medical aesthetics market is projected to reach USD 51.7 billion by 2032, growing at a CAGR of 13.3%.

- Procedure Trends: Dominated by non-invasive treatments, the market favors soft tissue fillers, chemical peels, and Botox due to less pain and lower costs.

- Leading Application: Skin resurfacing and tightening command the largest share, fueled by increased demand for advanced skin rejuvenation technologies.

- Primary End Users: Hospitals and clinics lead as primary providers of advanced aesthetic treatments, with home care gaining traction for its affordability and convenience.

- Key Market Drivers: Growth is spurred by the rising preference for minimally invasive treatments, the popularity of home-based aesthetic solutions, and ongoing technological innovations.

- Market Constraints: Social and ethical concerns, along with the stigma around cosmetic treatments, pose challenges to market growth.

- Regional Dominance and Potential: North America holds over 35% of the market revenue, while Asia Pacific is poised for the fastest growth, led by China, India, and South Korea.

Medical Aesthetics Statistics

- In 2015, the U.S. saw 14.2 million non-surgical cosmetic procedures, underscoring the popularity of less invasive aesthetic treatments.

- The UK’s non-surgical aesthetics sector is poised to surpass a market value of £3 billion in the coming year, reflecting significant demand.

- In 2020, surgical procedures dominated China’s medical aesthetics services market, comprising about 69% of the total market share.

- Between 2021, surgical aesthetic procedures in the U.S. surged by 54%, while non-surgical treatments increased by 44%, showing a growing consumer interest.

- In 2021, non-surgical cosmetic procedures experienced a growth rate of 44%, outpacing surgical interventions in the aesthetics industry.

- Body-focused non-surgical treatments surged by 63% in 2021, showing the highest growth among non-surgical aesthetics procedures.

- Liposuction procedures experienced a significant rise, increasing by 66% in comparison to the previous year.

- Abdominoplasties saw a 49% growth in 2021, marking a substantial uptick in demand for this surgical procedure.

- By 2015, non-surgical procedures accounted for 42% of total aesthetics industry expenditures, surpassing $5 billion for the first time.

- The skin rejuvenation sector within non-surgical procedures received about $1.9 billion in 2021, highlighting its rapid growth.

- Non-surgical skin tightening rose in popularity from 9th to 7th place overall and became the 5th most favored procedure among men.

- On average, each plastic surgeon conducted 320 surgical procedures in 2021, up from 220 in 2020.

- The cost for surgical procedures increased by 6% in 2021, whereas non-surgical procedure costs rose by just 1%.

- Women represented 94% of all cosmetic procedures conducted in 2021.

- Breast augmentations totaled 365,000, with 148,000 implant replacements, a 32% increase from 2020.

- A total of 71,000 women had breast implant removals without replacements, marking a 47% increase.

- Although only 21% of the procedures were surgical, they generated 69% of the total revenue.

- Facial procedures increased by 55% in 2021, largely due to the “Zoom Effect” influencing consumer demand.

- Women aged 17-35 primarily chose breast augmentation, with a total of 162,700 procedures recorded.

- For women aged 36-50, liposuction was the most common surgery, tallying 251,500 cases.

- Among those aged 51-70, liposuction continued to dominate, with 108,100 procedures noted.

- Blepharoplasty, targeting eyelid rejuvenation, was favored by women over 71, with around 15,000 surgeries performed.

- Liposuction tops the list of surgical cosmetic procedures for men, with 30,806 individuals opting for this body contouring technique.

- Gynecomastia surgery, or male breast reduction, follows with 22,467 cases, addressing excess tissue in men’s chests.

- Blepharoplasty, which rejuvenates eyelids, is the third most popular, involving 18,688 procedures to enhance the eye area.

- Rhinoplasty, focusing on nose enhancements, was performed in 10,487 cases, shaping and refining nasal structures.

- Abdominoplasty, commonly known as a tummy tuck, was chosen by 7,335 men seeking to improve their abdominal profile.

- Facelifts, aimed at facial rejuvenation, were selected by 5,061 individuals, enhancing facial aesthetics through surgical lifting.

Emerging Trends

- Technology Integration: The use of Artificial Intelligence (AI) in aesthetic medicine is becoming more prominent. AI is increasingly utilized for facial analysis in virtual consultations, recommending specific areas for treatments like neurotoxins, fillers, or laser procedures. Advanced imaging techniques are also used to create 3D models of a patient’s face to simulate potential surgical outcomes and aid in treatment planning.

- Regenerative and Microneedling Treatments: There’s a growing focus on regenerative medicine using patients’ own cells, including PRP, exosomes, and stem cells, to enhance the natural healing processes of the skin. Additionally, microneedling continues to gain popularity for its effectiveness in promoting skin rejuvenation, contributing to the ‘glass skin’ look that is highly sought after for its smooth, hydrated appearance.

- Consumer-Driven Changes: Consumers are increasingly seeking cost-effective treatments due to financial constraints, yet they exhibit a strong brand loyalty. This has led to a demand for new, lower-cost service-delivery channels. The medical aesthetics market is also diversifying its consumer base, with more individuals across different demographic groups showing acceptance towards aesthetic treatments.

- Innovative Non-Invasive Procedures: The industry is seeing a rise in non-invasive procedures such as needle-free enhancements and minimally invasive neck lifts, which offer significant aesthetic improvements with minimal downtime. These procedures are aligned with the trend towards treatments that avoid an overdone look and focus on enhancing natural beauty.

- Holistic Approaches to Beauty and Wellness: There’s an increasing integration of wellness and aesthetics, with treatments not just focusing on immediate aesthetic improvements but also on long-term health benefits. This includes the rise of medical weight-loss clinics and IV therapy programs that offer comprehensive wellness solutions alongside traditional aesthetic treatments.

- Embracing Individual Beauty: The industry is moving towards embracing individual beauty and diversity, utilizing specific techniques to enhance rather than change one’s natural features. This approach values the uniqueness of individual facial features and body types, moving away from one-size-fits-all solutions and towards more personalized care.

Use Cases

- Increased Acceptance and Diversity of Consumers: The acceptance of non-invasive aesthetic treatments has significantly increased, with a McKinsey report noting that 81% of consumers are now more accepting of these treatments compared to five years ago. This change is largely influenced by social media, which has helped normalize aesthetic procedures and attract a broader, more diverse consumer base including a significant increase in male consumers.

- Expansion of Service Access Points: The availability of medical aesthetics services has expanded considerably. Aesthetics clinic chains, med spas, and beauty bars are now more prevalent, providing easy access to treatments. This trend is supported by substantial investment from private equity, indicating a bullish outlook for this sector.

- Innovation in Procedures: Technological innovations continue to enrich the medical aesthetics landscape. For example, newer neuromodulators and dermal fillers are being developed to extend the duration of effect, and energy-based devices like ultrasound and radiofrequency are being used for skin tightening and body contouring.

- Integration of Advanced Technologies: There is a rising adoption of cutting-edge technologies such as robotic surgery in medical aesthetics. These technologies are enhancing precision in procedures like knee arthroplasties and improving patient outcomes with less invasive methods.

- Growth in Specific Procedures: Procedures such as skin resurfacing, body contouring, and laser hair removal are seeing high growth rates due to increasing consumer awareness and technological advancements that make these treatments more accessible and effective.

Key Players Analysis

- AbbVie Inc., a key player in the global medical aesthetics market, has significantly enhanced its capabilities in this sector since acquiring Allergan in 2020. This strategic move has bolstered its research and development efforts, focusing on innovative solutions in aesthetic medicine. AbbVie’s strong market presence is supported by its extensive portfolio and pipeline, which are backed by rigorous data analytics and insight mining to better understand and meet consumer needs. The company is well-positioned for growth, leveraging technological advances and technical expertise to lead in medical aesthetics.

- Sisram Medical Ltd., a prominent player in the medical aesthetics sector, reported a 2023 revenue of US$359.3 million, marking a 1.4% increase year-over-year. The company has strengthened its market presence through innovations in R&D, launching new products like Soprano Titanium™ and Alma Veil™ in North America, and expanding its injectables line. Their direct sales strategy contributed significantly to their revenue, achieving a record high of US$281 million in 2023, underscoring their growing influence in the global medical aesthetics market.

- Merz Aesthetics, a leading entity in the medical aesthetics industry, actively engages in advancing the field through innovation and scientific exchange. In 2023, the company highlighted its commitment by presenting emerging trends in regenerative aesthetics and a robust product portfolio at significant industry events like the Aesthetic and Anti-Aging Medicine World Congress. These efforts underscore their focus on enhancing healthcare professionals’ capabilities to deliver superior patient outcomes, reinforced by their participation in global forums designed to foster collaboration and drive forward the medical aesthetics discipline.

- Cutera Inc., a notable entity within the medical aesthetics sector, reported its full-year 2023 revenue to be approximately $205 million, showcasing its substantial market presence. The company specializes in advanced non-surgical solutions, particularly noted for its innovative treatments like AviClear for acne and truBody for body sculpting. These offerings highlight Cutera’s commitment to technology-driven, high-performance aesthetic improvements, which not only meet but often exceed client expectations. Their approach combines cutting-edge technology with a strong focus on customer satisfaction and clinical efficacy, securing its position as a leading choice for practitioners worldwide.

- Medytox, Inc., a prominent South Korean biopharmaceutical company, has established a significant presence in the global medical aesthetics sector through continuous research and development, particularly in botulinum toxin products. Since launching its flagship product Meditoxin® in 2006, Medytox has achieved a market share of nearly 40% with a diverse portfolio that includes several other botulinum toxin brands. The company’s strategic focus on innovation and expanding its product pipeline underscores its commitment to advancing medical aesthetic treatments worldwide.

- Solta Medical Inc., a division of Bausch Health Companies Inc., is a prominent entity in the global medical aesthetics market. The company specializes in innovative, energy-based medical devices for aesthetic treatments. Solta Medical provides a range of products under leading brands such as Thermage®, Fraxel®, and Clear + Brilliant®, which address skin rejuvenation, tightening, and body contouring. With over two decades of expertise, Solta Medical has established a strong reputation for delivering safe and effective aesthetic solutions with minimal downtime, catering to a wide array of skin treatment needs across more than 50 countries.

- Sientra Inc., a medical aesthetics company headquartered in Irvine, California, specializes in a range of products designed to enhance self-confidence through surgical aesthetics. Their offerings include FDA-approved fifth-generation breast implants, the innovative AlloX2® and AlloX2Pro™ tissue expanders, and the Viality™ fat transfer system. Despite recent financial struggles leading to a Chapter 11 bankruptcy filing in February 2024, Sientra continues operations, backed by $22.5 million in debtor-in-possession financing to maintain service and product availability while exploring a sale of the company.

- Johnson & Johnson and Hologic Inc. are significant contributors to the growing medical aesthetics sector. Recently, Hologic sold its Cynosure medical aesthetics division to Clayton, Dubilier & Rice, positioning it for accelerated growth with a focus on light-based technologies such as laser treatments for skin, body contouring, and women’s health. This sector is thriving due to technological advancements and increased consumer interest driven by social media and an aging population seeking non-invasive aesthetic improvements.

- Sciton Inc., based in Palo Alto, California, has made significant strides in the medical aesthetics sector, particularly through its advanced laser and light source technologies. Celebrating over 25 years of innovation, Sciton is recognized for its high-quality devices like the JOULE and mJOULE platforms, which are designed to offer versatile treatments such as skin rejuvenation, wrinkle reduction, and scar treatment. The company’s commitment to excellent customer service and continuous technological advancements has enabled it to achieve a strong market presence, marked by a consistent record of growth.

- Bausch Health Companies Inc. operates prominently in the medical aesthetics sector through its subsidiary, Solta Medical, which is a leading provider known for its innovative skin rejuvenation and body contouring solutions. With products like Thermage®, Fraxel®, and Clear + Brilliant® lasers, Solta Medical has performed over six million procedures globally. The company has experienced significant growth, with a notable revenue compound annual growth rate (CAGR) of 32% from 2017 to 2020, indicating a strong market presence and demand for their aesthetic solutions.

Conclusion

In conclusion, the medical aesthetics market is on a robust growth trajectory, driven by consumer preferences for minimally invasive procedures and significant technological innovations. Despite challenges such as high costs and limited insurance coverage, the sector continues to thrive, supported by a growing acceptance of aesthetic treatments across diverse demographic groups. Key players are investing heavily in research and development to stay at the forefront of industry advancements. The integration of advanced technologies and a shift towards personalized, holistic approaches to beauty underscore a dynamic market poised for continued expansion. This optimism is bolstered by strategic industry movements and a focus on inclusive, accessible aesthetic solutions.

Discuss Your Needs With Our Analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)

Request a Sample Download PDF

Sources.

newbeauty.com

iapam.com

mckinsey.com

nextech.com

medestheticsmag.com

mckinsey.com/industr...

bcg.com

marketscreener.com

abbvie.com

merzaesthetics.com

insightscare.com

soltamedical.co.uk

investors.sientra.co...

plasticsurgery.org

cdr-inc.com

sciton.com

stockanalysis.com

media.market.us

globenewswire.com

SHARE:

Trishita has more than 8+ years of experience in market research and consulting industry. She has worked in various domains including healthcare, consumer goods, and materials. Her expertise lies majorly in healthcare and has worked on more than 400 healthcare reports throughout her career.

Latest from Author

- Medical Imaging Market to Reach $48.8 Billion by 2032, CAGR of 5.40%

- Corporate Wellness Market to Reach $100.8 Billion by 2032

- Blood Transfusion Diagnostics Market To Reach USD 9.1 Billion By 2032

- Viscosupplementation Market To Surge Beyond USD 7.7 Billion By 2033

- Flow Cytometry Market to Reach $104.4 Billion by 2032 with 7.5% CAGR