This is the tale of a technology enabled phoenix. This is the tale of the death of a startup. It is the tale of betrayal and survival. It is long. It is a tale of redemption. It is worth the read.

In the year 2011, I was inspired to start a technology-enabled primary care practice that would cut the cost of healthcare in half while 10x-ing the patient experience. I knew a lot about healthcare but nothing about running a clinic. Yet, I knew that I had done harder things and that I could create a better more affordable offering than the then current solutions.

The Wantrapreneur

In 2011 I was still all talk though, a straight up wantrapreneur. It was not until late 2012 that I made a serious run at starting this company when my friend Pete Kane said to me while walking over the Mississippi — “dude, just start it already”. This was the age of the Lean Start-Up, Accelerators, and Tech Crunch, so my mind was full of the latest startup catchphrases, strategies, and success stories… The company was called RetraceHealth and the value proposition was simple. For one fixed monthly fee users would get unlimited access to tech-enabled nurse practitioners via video or home visits. In addition to the visits, they would get unlimited access to in-home labs and X-rays.

I hired a fairly fresh college grad named Kendra Perez (formerly Kendra Allen) and together we built the technology backbone of the company using over a dozen SaaS solutions and pasted them together via API for what was a pretty seamless customer experience from a technology perspective. I also had to source things like malpractice insurance and legal advice. Kendra worked with our first 2 nurse practitioners Jessica and Elizabeth to source all of the equipment, supplies, and vendors we would need to deliver our tech-enabled video to home visit medical care. We took bootstrapping to the extreme. We pumped the PR machine and got tons of local press. We did a lifetime membership campaign and sold lifetime access for $300 a person. I thought that although we were in Minneapolis Minnesota, we would sell at least 1,000 of these lifetime memberships and use the cash to fund operations for the first few months. I was confident that people would want this service with healthcare costs on the rise. I was wrong. Dead wrong. We only sold about 30-lifetime memberships, and on top of that, not a single person purchased a full priced membership.

Real Revenue!

Six months in, now with three employees, and also a hundred thousand dollars in debt I realized something had to change. During this time, I met a gentleman named Bill Manning who read about me in an article and decided he had to meet me. We met throughout a few months for hours at a time discussing strategy on how to fix my stagnant start-up. He thought selling through employers would be a good idea despite my reservations on the long sales cycles, so he introduced me to a company called AFG (now ABRC). This was a large health insurance broker. One of their top consultants Jon Heidorn liked our product and sold it to one of his largest clients. This was our first real revenue! The annual contract value was about $20,000. I thought we were certainly on to something. I went with Jon to numerous other local Minnesota companies and much to my surprise, only two more signed up. Yet, I was not deterred, I figured that healthcare is notoriously slow to adopt new things and that given enough time things would improve.

Getting Investment The First Time

Growthpersonal debt

Shortly after raising the seed round I added a cofounder to the company so we could split duties, risk, and fill in for my weak spots on branding, marketing, technology, and experience. His name was Steven Bayer, and he was a significant win for the company. It allowed me to focus on people, sales, operations, legal, and finance. We were fortunate to get copious amounts of local and national press despite being from the middle of the country.

Even with the team falling into place, PR coming naturally, an amazing well-crafted company culture, and our clients loving the service — growth was anemic. We needed more cash. Based on my projections, if we could raise another $500,000, we would have enough runway to make it cash flow breakeven. I set about to raise this small bridge round and was unsuccessful after two months. With only six months of cash in the bank I changed strategy and set out to raise a Series A. Within three months we landed $7 million with a local VC taking the lead, and we closed June 2016. It was not exactly what I wanted, but it was the only way I thought I could keep the company alive.

Terminated

By October 2016 we hit $1 million in ACV effective for January 1, 2017. The year 2017 was looking bright, and I could see the light, I believed (and still do) that we could build a billion-dollar company as I could see the growth rate accelerating rapidly and market forces aligning.

“Then without any warning, in that same month, the lead investor and one of our original investors notified me that myself and Steven were terminated.

To this day we don’t know why they did this. Especially the original investor who had become a close confidant, mentor, and friend. When he and the lead investor terminated me, I looked him in the eye and told him how much I respected him and valued his mentoring. I still do to this day as I write this. I also told him he was making a mistake and destroying shareholder value by removing me at such a critical point in the company’s life. I said him I doubted the company would last more than a few months without me and that the strategies proposed by the Series A investor I had blocked, I blocked for a good reason to protect the company. But he and the lead Series A investor did not listen to me, and there was nothing I could do about it. Less than five months after thinking I saved the company I lost the company.

Clients and employees were angry and shocked. I was too. And based on the flood of phone calls and emails so was the entire city of Minneapolis. The one thing I kept telling myself is, well, at least if they run the company well and succeed, I will also as I still owned roughly 25% of it. Unfortunately, even this remnant of hope was dashed to pieces when it was announced in April 2017 that the company was shutting down. I am still scratching my head as to what happened because it was clear to me and the rest of the team and our distributors that we were going to build something significant and valuable if we stuck to my roadmap. The disappointment was doubled by the thought of all the value that the team had built that was lost. So much for stock options.

“It was around this time that I started following Bryce Roberts and Indie.vc, and I was like “damn, wish I would have found this guy 6 months ago!

And life still had to go on during all of this. My second son was born a month before I was terminated from my own company — so good sleep and regular exercise also got terminated. And now I had to start thinking about how to generate an income quickly. Having a baby around did put things in perspective and made me realize that life was more than startups. And by changing the way I viewed things I saw more good things about my situation. For example, I was able to spend most of November and December of 2016 just focusing on my now larger family during the holiday season with zero distractions.

The Side Hustles

I started a side hustle of a tech startup called Relate I had wanted to start but never did since even before RetraceHealth. I came to an even more in-depth understanding of how healthy my marriage is. My wife was incredibly supportive. Without her, I would have gone back to regular employment. She kept me sane and made me feel bigger than I am. My parents, siblings, and Uncle were the same way, as were my mentors. The entire Twin Cities startup ecosystem was the same way. I had support enough to launch me to the moon. The employees of the now-defunct company all and I remained in touch and got together in small groups regularly. Steven and I worked on some projects together too, and our sons hung out at the pool.

Because we had extra time, my wife and I decided that she should start a business. She launched Mill City Laser in January 2017 with the goal of upending the growing laser hair removal industry. And wow, we joke that if any of my startups had grown at half the rate of her business, we would be rich. Her company is doing great — by focusing on cash flow, it reached cash flow positive within 12 months while paying her a salary. We still needed more income in the short term, and I again got lucky. Two of my mentors had recently started a new company and had raised well over $70 million and wanted someone to help out with analytics, so I consulted in January 2017 while working on Relate. In addition to Steven, I was working on Relate with two of the former employees at RetraceHealth, Allison and Genevieve. Steven eventually joined a great startup and had to focus on that.

Restarting The Company Again

When Allison, Genevieve and I would work on Relate, we would occasionally reminisce about RetraceHealth and the amazing culture we had. We would talk about tiny mundane operational changes we had wanted to make but never got the chance to. But mostly, we talked about how the old business was working and required no significant changes and how we would never, ever do it again. It was all too close still and stung too much. During this time Patrick Tollefsrud, an executive from ABRC which was the largest distributor of RetraceHealth reached out to me. Patrick cared deeply about how I was fairing. We had met for lunch a few times already. This time when we met, he encouraged me to restart the company. He told me that many of the old clients believed in the mission and value and wanted the service back for their employees.

“My immediate reaction was no. I did not want to do it again. Allison and Genevieve felt the same way.

Over the following months, more and more founders in the local startup community told me they wished I would restart RetraceHealth. Not because they knew anything about the service or why it should exist from an industry perspective, but because they believed that what happened was wrong and that by restarting the company the entire startup ecosystem would benefit from the story of resilience. Clarence Bethea, Casey Allen, my parents, and my wife were particularly persuasive and supportive.

Allison, Genevieve and I were talking one day, and I think we all came to the same realization at the same time — we should carpe diem the shit out of this opportunity. Genevieve would run operations and clinical, Allison would run client services and logistics, and I would finance, legal, technology, and distribution. We formed the company as equal co-founders. We knew it was going to be painful to bootstrap — but the opportunity was tremendous.

This Time No Money From VC’s

And this time we knew we were not taking money from VCs. Well, except I knew that Indie.vc was no ordinary VC and was able to convince Allison and Genevieve that it would be safe to take money from them. In August 2017 I filled out the form on Indie’s website telling them the entire story of RetraceHealth and how this would be a great investment opportunity correctly, in-line with their thesis. I said them we were going to launch in October 2017 and would be cashflow positive in less than 24 months.

A few days later we got an email from an associate saying they do not invest in pre-revenue companies, even companies that had customers locked in. So, we had to use our own money and personal debt to launch the new company called Nice Healthcare. My parents believed in what I was doing and also loaned us $100,000. It took us three months to stand up the new company. The first time it took two years. Within four months we had ARR of $400,000. At the last company, it took over three years to get to the same level of revenue. We named the new company Nice because we decided we would only work with Nice people. Still — the cash constraint was a little too much.

Having an initial batch of customers from the previous company helped, but it did not change the fact that this business model does not breakeven until it achieves $750,000 in ARR. The reason is, it is not possible to MVP a technology-enabled healthcare service company, things have to work, and regulations must be adhered to on day 1. We needed a little more cash to make our technology and service 100 times better than a regular clinic.

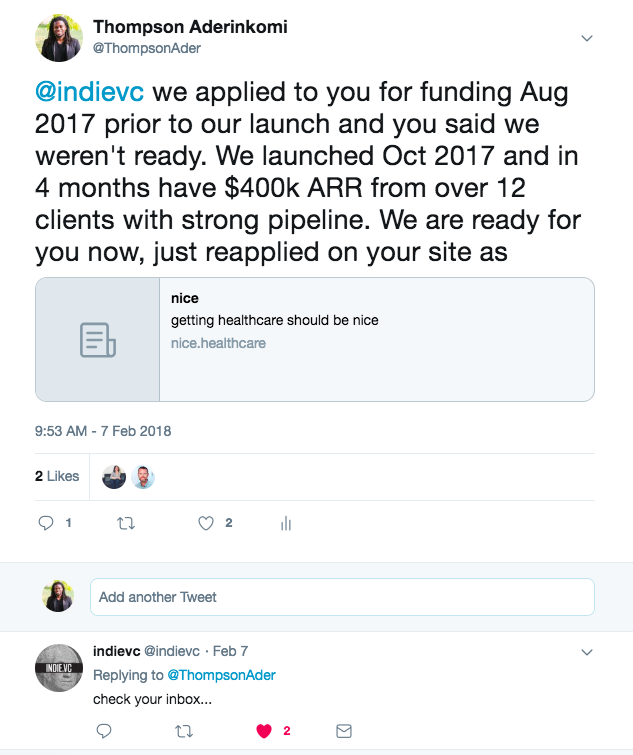

I continued to read and retweet everything Bryce posted on Twitter religiously. One day, I was reading about Sarah Van Dell at Plum Relish and her story about how she raised $500,000 from Indie.vc by Tweeting at Bryce. So, in a knee jerk reaction on February 7, 2018, five months after launching Nice Healthcare, I imitated Sarah and Tweeted at Bryce directly for the first time. Bryce got back to me in a few minutes.

Throughout two months we had three, 30-minute phone calls that ended with Indie.vc investing $350,000 into Nice Healthcare in May 2018. I never even met Bryce in person before we closed.

Even better and more unusual, the diligence was fast, a testament to how Indie.vc operates (it also helped I had done a Series A so we were ready with a secure data room). The questions he asked me were so different than the questions I was asked when raising and closing the $1,000,000 seed or the $7 million Series A for the previous company. He asked me all the things that I would ask a founder if I was an investor regardless of the size of the check. He did not request a single question that made me roll my eyes. I am sure Bryce could sense by guardedness due to my previous experience, and he was very understanding of my lack of trust.

Indie VC

I can honestly say that I wish every founder would get the chance to take money from Indie.vc. Bryce does not ever make you feel like he knows more than the founder. But he somehow can make you understand that he has a different perspective that is worth listening to. He has challenged me on things that he was right, and I am glad he did. My cofounders and I are determined to not only make Nice Healthcare a considerable success but to also prove the Indie.VC thesis correct. For the majority of founders, if they viewed sales and distribution in the same way as raising capital from traditional VCs, they will find they do not need the traditional VCs. The investment from Indie.vc allowed us to invest in hiring more staff to improve our response times and to invest in our prescription delivery feature. We knew doing both of these things would allow us to grow faster and get to break-even sooner. Allison, Genevieve, and I want to grow big, grow fast, and be profitable all at the same time.

Fifteen months into operations we achieved $1 million in ARR and are continuing to grow fast. Our gross margins are approaching 50% and January 2019, our 16th month of operations, will be our first cash flow positive month.

Even with fast growth we are still investing heavily into technology development and are maintaining a strong company culture (90% of the employees were employees at the previous company a testament to the amazing culture we had the first time.) And of course, patients and clients love the service, our NPS is holding steady at 90%. We are unstoppable.